What is a 1031 Tax Deferred Exchange?

A 1031 Tax Deferred Exchange can benefit a taxpayer by offering them savings on taxes. Typically, taxes are due upon the sale of a piece of property. However, Section 1031 of the Internal Revenue Code outlines a process wherein you can sell investment or business property and buy a “like-kind” piece of property without paying capital gains tax on the sale.

What are the requirements for a 1031 Tax Deferred Exchange?

- The properties involved in the exchange must be used for investment or business purposes.

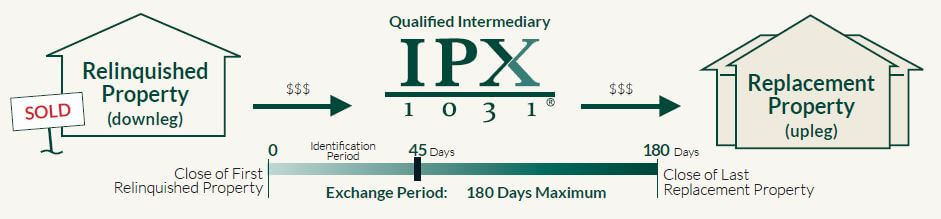

- You must identify the replacement property within 45 days of the closing for the sale of the original property.

- You must close on the purchase of the replacement property within 180 days of the closing for the sale of the original property.

- The replacement property must be of equal or greater value than the original property (otherwise, taxes will be due on the difference).

- The two properties must be considered of “like-kind” to one another (ex: both must be real property).

- You must use a Qualified Intermediary as a third party to hold the proceeds from the sale and transfer the funds for the purchase of the replacement property. Covenant partners with IPX, a trusted Qualified Intermediary when we are handling a 1031 Exchange.

What are the benefits of participating in a 1031 Tax Deferred Exchange?

- Deferring taxes allows you to keep more of your money so you can build your wealth faster.

- It is a great tool for diversifying or consolidating your real estate portfolio.

- It can allow you to upgrade the types of properties that you own.

- It gives you the opportunity to expand into other real estate markets.